When embarking on either a disposal or fund-raising process, it’s essential to have a robust financial model in place for

More

HMT has advised multi-award winning Audio Visual, IT, Unified Communication (UC) and Automation systems and solutions specialist SmartComm on their

More

HMT LLP advised LDC-backed communication tech and cloud communications specialist Onecom on their acquisition of IT managed services and communications

More

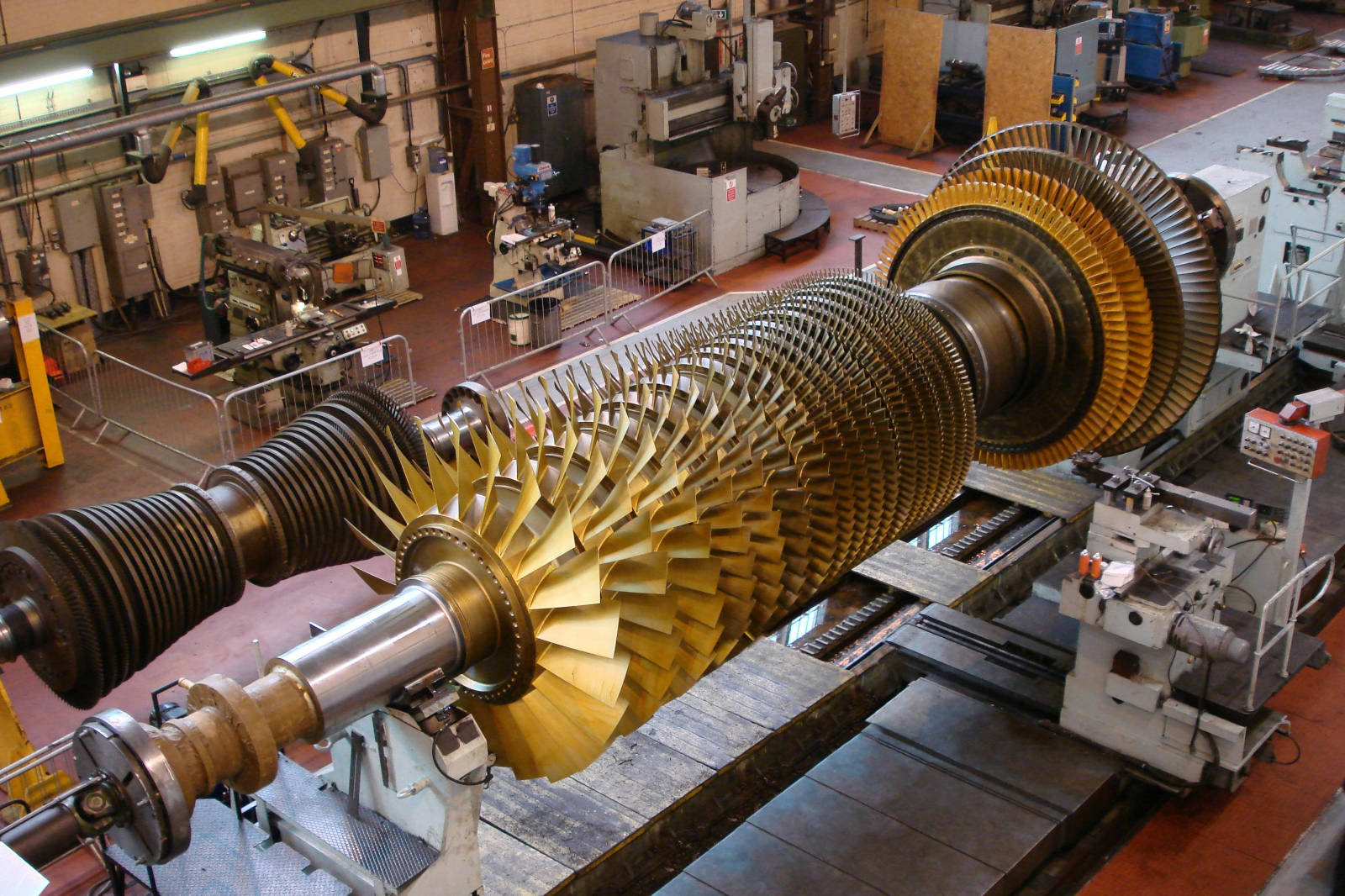

HMT LLP advised global leader in renewable energy RWE on their disposal of Ferrybridge Engineering Workshop business to TGM Industrial,

More

Can you set out to build a salable business from the start ? I frequently run workshops for entrepreneurial mid-market

More

HMT LLP, led by Partner Paul Read, Director Corin Briault-Hutter and Manager Francis Drysdale advised Connection Capital in its investment

More

HMT LLP advised Key Capital Partners on their £9.1million investment in integrated property services provider SJA Group. SJA was established

More

Throughout the last few years, a desire to reduce back-office headcount, downsize office space and outsource non-core activities to specialist

More

HMT LLP advised property services group Leaders Romans Group (‘LRG’) on their acquisition of Peter Ball and Alexander & Co.

More