TaxCalc receive significant investment from STG Allegro to support growth

HMT advised the shareholders of TaxCalc, the leading provider of tax compliance and practice management software for UK accounting firms, on their significant investment from STG Allegro, a private equity partner to market-leading companies in data, software, and analytics.

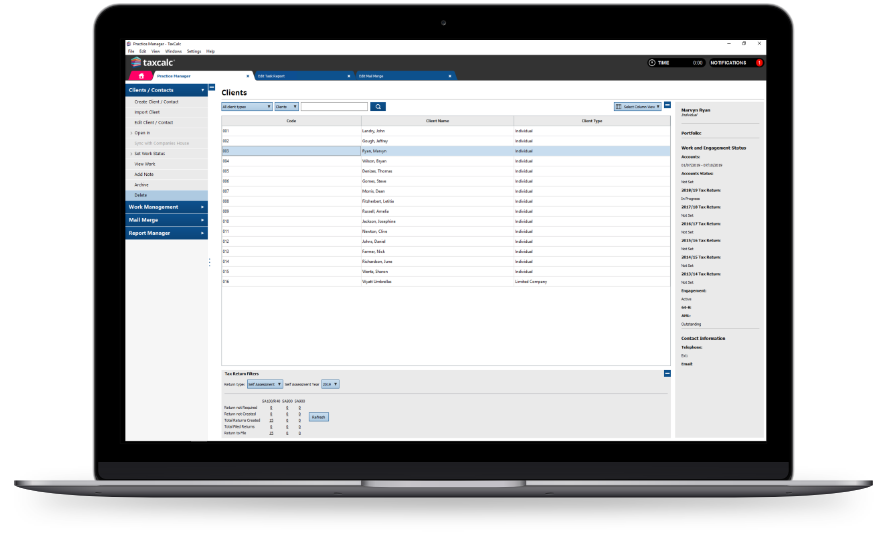

Founded in 2004 by Tracy Ebdon-Poole, TaxCalc has become one of the most trusted brands in the UK tax and accounting software sector. TaxCalc has been focused on providing high levels of customer support and a relentless drive for improvement and new product development. Under Ebdon-Poole’s leadership, TaxCalc has grown from a small team of five to an industry leader, with over 135 employees and 11,000+ accounting firm customers. In recent years, TaxCalc has expanded its capabilities to address a growing customer base through market-leading products such as CloudConnect, VAT Filer, FRS 102 MLA, and Group Accounts with more exciting releases expected to come. The company has achieved significant success, often winning major industry accolades, including AccountingWeb’s Software Excellence Awards and the Institute of Certified Bookkeepers LUCA Awards.

The company intends to partner with STG and to use the capital to continue enhancing its product offerings, invest in customer success, and introduce new innovative offerings to deliver value for its growing accounting firm customers as they migrate away from legacy and under-invested tax compliance and practice management software solutions.

HMT acted as lead advisors on the transaction which included assessing the strategic options for the shareholders and management, identifying suitable investors, negotiating detailed terms, supporting the business through an extensive due diligence process and project managing the deal to a successful completion.

Tracy Ebdon-Poole, Founder of TaxCalc commented:

“Finding the right strategic partner for TaxCalc has always been of paramount importance to me. One that embraces our corporate values with a customer and team-centric approach. I’m delighted that STG are that partner. Throughout the whole process, Wendy Hart and her team’s consummate professionalism, guidance and unwavering support, ensured that our values were aligned and a smooth transition could be achieved both for our customers, and our high-performing team.”

Wendy Hart commented:

“We are thrilled to have run the process that resulted in the happy union of TaxCalc and STG. TaxCalc has attracted a lot of market interest over the last couple of years and so we tailored our approach carefully to recognise the priorities of our clients and to minimise disruption to the business. We are delighted to have concluded a deal that met the objectives of all the stakeholders, and which sets TaxCalc and its management team up for an exciting new phase of growth.”

Why HMT

Latest News