Investment in ADC Biotechnology by Maven

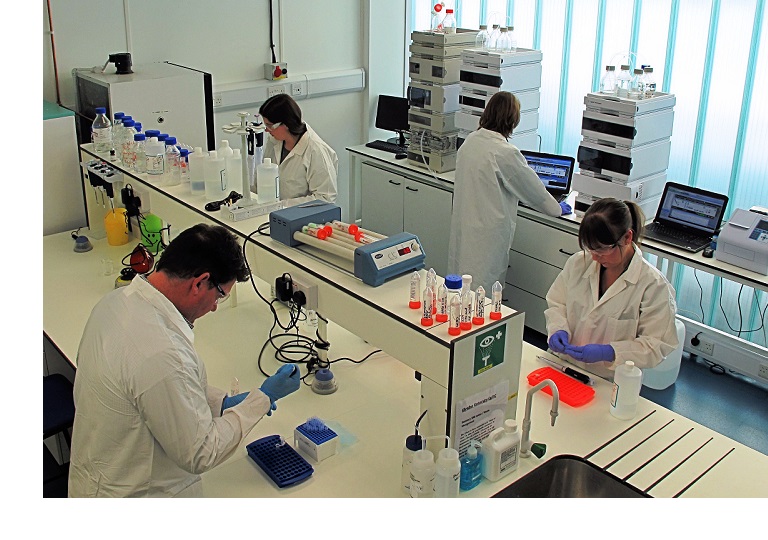

HMT LLP advised Maven Capital Partners on their investment in anti-cancer drugs manufacturer ADC Biotechnology.

ADC Bio operates in the highest growth sector within oncology therapeutics and has developed a unique patented Lock-Release technology for the development and manufacture of Antibody Drug Conjugates (ADC) group of cancer therapies which are designed to specifically target and kill tumour cells. Known as ‘magic bullets’, ADCs are the next generation of anti-cancer drugs which combine the unique targeting capabilities of anti-bodies with the cancer-killing ability of cytotoxic drugs. The Lock-Release technology facilitates greater production efficiencies and a substantial reduction in the capital cost of manufacturing these drugs for commercial sale.

Maven invested in ADC to help fund the development of an £8 million dedicated pharmaceutical manufacturing facility at a site in Deeside, North Wales, creating 50 new skilled scientific jobs. The investment will allow ADC Bio to move into manufacturing for clinical and commercial use.

HMT undertook financial due diligence on this transaction.

Melanie Goward, Investment Director at Maven commented:

“The HMT Transaction Services team provided an excellent financial due diligence service. Their advice was clear and concise, and they produced a high quality report which highlighted all key issues in a clear and easily understandable way. We were delighted to work with HMT and would be happy to repeat the experience in the future.”

Paul Read commented:

“We are delighted to have advised Maven on another VCT transaction. We look forward to working with them again in the future.”

Why HMT

Latest News